innovative and engaging artwork.

social and economic inequality.

wealth distribution.

what is so taxing about taxation?

Opening Reception: June 22, 2012 from 6 – 10 PM at the CAH

Featuring drinks, classy appetizers, and the fabulous DJ Mike B

With no limitation to the style or media of pieces created for PoorQuality: Inequality, a portion of the artists, which included sculptors, painters, book artists, video artists, and photographers, branched out stylistically from their normal medium, while others pushed conceptual boundaries.

Some chose to explore how to visualize analytical data. Suzanne Broughel used color to interpret the U.S. racial wealth gap by decorating a white bed sheet “canvas” with coin marks made by dipping quarters and pennies in liquid foundation makeup and pressing them on the fabric. Peter Lisignoli, an MFA student at Duke University, became interested in how one represents the absence of food. He photographed a Quick-n-Go market to rethink how space and time are rendered by such a space. Despite his efforts to tackle the social issue of food inequality, his project changed focus toward the ghettoizing gaze of the surveillance camera.

Other artists explored the capacity for art to spark an emotional response to the research presented by the Center for Advanced Hindsight. Leslie Salzillo’s “The Rise of Soraya M (What Does that Make Her?)” honors all women who have suffered small and great injustices created by the unequal legal and social double standards misinterpreted to dehumanize women.

June 1, 2012 – August 31, 2012

Open to the public Monday – Friday 10 AM – 3 PM

When we decided to create the Artistically Irrational series, we hoped to catalyze the scientific process by bringing art directly into the place where we work and think.

Behavioral research is an indispensable tool for social scientists looking to understand and comment on the fascinating world in which we find ourselves. Controlled experiments allow us to measure and reflect on issues ranging from injustice to advertising, the taste of beer to medical conflicts of interest, and even social networks like Facebook or Twitter. Such experiments allow us to reliably test whether our intuitions about the world are true and figure out when, how, and why we are wrong. Art fills a similar void, filtering ideas and motivations through individual sensibilities, then taking the result and crystallizing it into something more or less universal. And although there are many differences between the worlds of Science and Art, both can provide useful social commentary. In fact, it is these very differences that invite a discussion between the two. We hope that, through this project, the scientific and artistic approaches can fertilize one another and expand the lines of communication between two fields that have so much in common but speak to one another so rarely.

The Artistically Irrational exhibition series is essentially an experiment in feedback loops. Each project begins with a discussion of social science research on a particular topic and a request for artists to express themselves through their art. Then, surrounded by the fruits of their labor, we get to further reflect on our research through their eyes, using their insights to enrich the meaning of our studies.

~ –– ~ –– ~ –– ~ –– ~ –– ~ –– ~ –– ~ –– ~ –– ~ ––

Creative Dishonesty: Cheat Codes

The first show revolved around our research on cheating and dishonesty. After I spoke to a group of artists, they went back to their studios and put together their interpretations of our findings. They came back with a range of pieces exploring the nature of dishonesty – especially as it related to their own practices. Several artists investigated the moral status of artistic “borrowing” and the thin line between appropriation and flat-out plagiarism. One artist played with the idea of citation, which is virtually nonexistent in art but is a practice with rigid requirements in the sciences (see APA, 2010). Another considered how the mere label of “art” affects how we experience something, whether it is a flattened steel grid or a topsy turvy urinal. Other artists examined the spiral of bad decisions that can spring from one little transgression, and how moral reminders or cleansing rituals can help us correct our misdeeds and start over. Many explored the ways that we lie to others and ourselves, how we hold distorted worldviews and memories – and the rationalizations that go along with them.

All of these pieces revolved around an interesting finding of our research: the tendency of creatives to be less honest than non-creatives. As David Hockney said, “the moment you cheat for the sake of beauty, you know you’re an artist.”

A Sample from the Show:

(click on images for larger view)

Photos taken by Aline Grüneisen

~ –– ~ –– ~ –– ~ –– ~ –– ~ –– ~ –– ~ –– ~ –– ~ ––

And because the Creative Dishonesty exhibit was such a success, we decided to host another art show, this time following the theme of social and economic inequality, wealth distribution, and what is so taxing about taxation. This exhibit, PoorQuality: Inequality has just been installed and will accompany me in the Center for Advanced Hindsight until August 31.

If you can make it, I highly recommend coming to our opening reception on June 22 from 6 – 10 PM.

For more photos and information about the Artistically Irrational exhibition series, see our website or contact curator Catherine Howard at artisticallyirrational@gmail.com

At one point the people who run Hudson Urban Bikes, a bike rental company in the West Village, wondered what would happen to a bike if it was left chained to a post in the city for one year, and they took a picture of it each day to document its progress. The bicycle began its experimental journey equipped with all necessary equipment plus a basket, water bottle, splashguard and a few other goodies.

For quite a while the bike sits quietly chained next to a host of other bikes, retaining all of its accouterment. Then, on day 160 all of a sudden the water bottle goes missing. Then a few weeks later on day 212, both the lock and the basket walk off. From there things really begin to deteriorate, and it’s not long before the seat is missing, followed soon after by the front tire, splashguard, and handle bars.

Finally the forlorn frame itself disappears.

To my mind, this experiment cleverly mimics several aspects of dishonesty. People are basically fairly honest most of the time, but at some point they are tempted to cheat or take one small thing, or they see someone else do so. Over time this works through them, and maybe they take another small thing. After a while, this becomes habit, and people begin cheating at full throttle, and next thing you know, the whole bicycle is missing (figuratively).

That said, I think it bodes well that the bike lasted as long as it did, particularly after the lock was removed. It seems we can rest a little easier knowing that people, for the most part, don’t cheat as much as they could, or as much as we would expect them too, rationally speaking—after all, just think of how many people walked by the apparently free, unlocked bike and ignored it.

In the experiments my colleagues and I have run on cheating, we’ve used a task in which pride about personal performance and ability has no part. The matrix test is merely a search task (wherein participants find the two numbers out of 12 that add up to 10) rather than a skill. It’s not something you’re going to brag to your friends about in all likelihood.

Recent graduate Heidi Nicklaus of Rutgers University was interested in the opposite; she wondered how people’s pride about their perceived and imputed abilities would affect their dishonesty. Specifically, she was interested in gender stereotypes. We’ve all heard the stereotype that men tend to excel at math more than women, and that women can talk and write circles around men with their superior verbal skills. So the question was, if men are more proud of their mathematic ability and women of verbal, it might cause them to cheat more.

In her experiment, Heidi first primed her participants with two comical videos that exaggerate gender stereotypes (see below). Then participants were presented with one of two sets of fake data (presented as legitimate); one supported the math versus verbal aptitude stereotypes, the other countered them. Finally, participants took brief 10-question tests measuring both math and verbal aptitude, and were told they would receive $.50 for each correct answer. Similar to the experiments my colleagues and I have run on cheating, half of participants in each condition could cheat while the other half could not.

The results showed that when people could cheat, they generally did, which is what I’ve always found in cheating experiments. On average, people claimed one extra correct answer than when cheating was not possible (an average of 4 instead of 3 correct answers out of 10 on both math and verbal tests). No news here, so what about the effect of gender stereotypes? Did having them reinforced or, alternatively, countered before taking the test have any influence on cheating?

First, the hypothesis. What Heidi expected to find was that men and women would cheat along stereotypical lines, that is, that men would cheat more on math (to show that they did, indeed, excel in mathematics) and women would cheat more on the verbal portion for the same reason. So it was intriguing when Heidi found that men cheated more on math question than expected, but men and women cheated equally on verbal questions (rather than women cheating more as anticipated).

These findings—that people did not cheat more to keep up with perceived higher achievement by others—are similar to what my colleagues and I have found. In one experiment our results showed, similarly, that people cheated by the same amount regardless of whether they thought their peers solved an average of 4 or 8 out of 20 questions in a given amount of time (reporting an average of 6 correct answers). People cheated as much as they could justify, and apparently others’ performance is not of any great concern in this justification.

Oh, and as for the stereotype that kicked off the experiment: there were no differences in performance on math or verbal questions based on gender. So hopefully this harmful stereotype will fall by the wayside sooner rather than later, since nearly all similar studies yield the same conclusion.

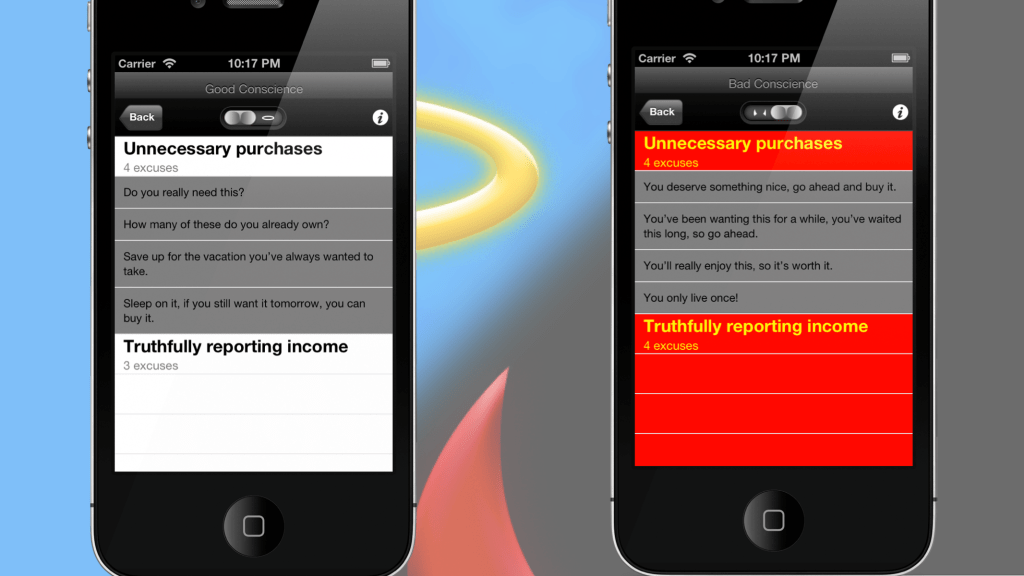

I’m pleased to announce that I have a new app available at the App Store called Conscience+.

Conscience+ helps you reason through moral dilemmas by providing you with little “shoulder angels” that can help you argue either side of a decision. Simply flip the switch at the top of the app to move between good conscience and bad conscience. Whether you need the extra push to go through with a selfish deed or words of wisdom to resist a bad temptation, Conscience+ has you covered.

- turning away the dessert menu

- splurging on a new electronic gadget

- staying faithful to your romantic partner

- padding your expense report on your boss’s dime

- lying on your college application

- and much, much more!

Get Conscience+ free from the App Store here! Once you’ve played with the app yourself, let us know in the comments if you have any suggested excuses. If we like them, we’ll put them in the next update.

This week, I visited a camera store to order two enlarged prints as a gift. I don’t order photo prints very often; in fact, I’m not sure that I have ever ordered prints aside from graduation photos. As I was making my purchase, the friendly, middle-aged woman who had been helping me asked whether I wanted to become a store “member.” I learned that for only 13 dollars and change, I could save 10% on purchases at the store for the next year, including around five dollars on the order I was purchasing. (I asked whether this discount applied to cameras. It did not.) After fleeting consideration, I explained that I did not think it was likely that I would be buying more prints in the next year, and hence membership was not a worthwhile purchase for me.

This week, I visited a camera store to order two enlarged prints as a gift. I don’t order photo prints very often; in fact, I’m not sure that I have ever ordered prints aside from graduation photos. As I was making my purchase, the friendly, middle-aged woman who had been helping me asked whether I wanted to become a store “member.” I learned that for only 13 dollars and change, I could save 10% on purchases at the store for the next year, including around five dollars on the order I was purchasing. (I asked whether this discount applied to cameras. It did not.) After fleeting consideration, I explained that I did not think it was likely that I would be buying more prints in the next year, and hence membership was not a worthwhile purchase for me.

To the friendly saleswoman, this did not seem be a satisfactory answer. She continued to push the membership offer, emphasizing the five dollars that I would be saving. “I don’t know about you,” she said, “but I’m someone who likes saving money.”

As I walked from the camera store to my car, I couldn’t help but contemplate this saleswoman’s comment. Did she actually believe that purchasing a camera store membership would benefit my bank account in the long run (as she appeared to), or was she simply a loyal store representative, eager to make additional sales (which seemed more likely)? Either way, her comment reflected a “save by spending” mentality that permeates modern-day America.

Membership programs and customer reward programs that charge an initial fee are prime examples of the “save by spending” creed. The customer is presented with various opportunities for future discounts, provided he or she coughs up money for a membership. As in my camera store situation, the membership offer is usually presented right before purchase, and the amount saved on the purchase itself is highlighted by the salesperson. The customer is forced to decide on the spot whether he or she would like to join.

Membership programs are rather curious in light of the established research finding that, in general, people will settle for less money if they can have it immediately – a tendency psychologists refer to as temporal discounting. (Think Money Mart loans or pawnshops.) In contrast, joining a membership program means foregoing money now for the possibility of earning that money back later on.

There are several reasons these programs may work. First, they force the consumer to project the likelihood of future purchases in a biased setting. People are notoriously bad at predicting the future; when buying an enticing summer novel at Barnes and Noble, surrounded by other books, one is more likely to consider spending money on books than on the variety of other products out there. Second, when presented with the membership program, people may experience mild social pressure from the sales associate. Third, if people are making their purchases with credit cards, they’ll be more willing to slap on an additional membership purchase; research attests that using credit cards makes people spend more, compared with cash.

Last but not least, the feeling of saving money is just plain rewarding. We know that money is valuable. At the same time, we don’t want to save by foregoing that sparkly new iPhone accessory. Membership programs offer us the opportunity to have our cake and eat it too – to experience the joys of saving and spending at the same time. And I’m guessing this makes companies pretty happy too.

Of course, membership programs aren’t the only example of our tendency toward saving by spending. Who hasn’t relished in the experience of buying a product at 50% off, focusing on that 50% that they have magically “earned”? I know I have. This may be part of the reason that the average American has half as much personal savings as personal debt.

Thank you, kindly saleswoman, but I will simply pay for my photo prints this time.

~Heather Mann~

Why We Lie (from the WSJ)

We like to believe that a few bad apples spoil the virtuous bunch. But research shows that everyone cheats a little—right up to the point where they lose their sense of integrity.

Not too long ago, one of my students, named Peter, told me a story that captures rather nicely our society’s misguided efforts to deal with dishonesty. One day, Peter locked himself out of his house. After a spell, the locksmith pulled up in his truck and picked the lock in about a minute.

“I was amazed at how quickly and easily this guy was able to open the door,” Peter said. The locksmith told him that locks are on doors only to keep honest people honest. One percent of people will always be honest and never steal. Another 1% will always be dishonest and always try to pick your lock and steal your television; locks won’t do much to protect you from the hardened thieves, who can get into your house if they really want to. The purpose of locks, the locksmith said, is to protect you from the 98% of mostly honest people who might be tempted to try your door if it had no lock.

We tend to think that people are either honest or dishonest. In the age of Bernie Madoff and Mark McGwire, James Frey and John Edwards, we like to believe that most people are virtuous, but a few bad apples spoil the bunch. If this were true, society might easily remedy its problems with cheating and dishonesty. Human-resources departments could screen for cheaters when hiring. Dishonest financial advisers or building contractors could be flagged quickly and shunned. Cheaters in sports and other arenas would be easy to spot before they rose to the tops of their professions.

But that is not how dishonesty works. Over the past decade or so, my colleagues and I have taken a close look at why people cheat, using a variety of experiments and looking at a panoply of unique data sets—from insurance claims to employment histories to the treatment records of doctors and dentists. What we have found, in a nutshell: Everybody has the capacity to be dishonest, and almost everybody cheats—just by a little. Except for a few outliers at the top and bottom, the behavior of almost everyone is driven by two opposing motivations. On the one hand, we want to benefit from cheating and get as much money and glory as possible; on the other hand, we want to view ourselves as honest, honorable people. Sadly, it is this kind of small-scale mass cheating, not the high-profile cases, that is most corrosive to society…..

For the rest of the article, please see the WSJ

As many of you know, I’ve recently been working on a new book. In fact, many of you helped me pick the title!

Well, I’m excited to announce that The (Honest) Truth About Dishonesty: How We Lie to Everyone — Especially Ourselves will be released in just a couple weeks on June 5th.

With new scandals popping out almost every week, and with substantial conflicts of interests in financial services, medicine, and government – understanding what makes us honest and dishonest is more important than ever.

Since many of you have been following me a long time, I want to offer a special invitation to my fans that pre-order the book

For the first 1000 people that pre-order a copy of The (Honest) Truth About Dishonesty, you’ll receive exclusive access to a special hour long live webinar where I’ll discuss the ideas in my new book, give you a sneak peak at the content and even open it up for some Q&A.

If you’d like to join me, here are the 2 simple steps:

1. Purchase the book at any online retailer and in any format:

![]()

![]()

2. Forward the receipt you receive from your retailer to arielypreorder@gmail.com

I look forward to having you and hearing your feedback on The (Honest) Truth.

I just received this letter from a friend in the banking industry. He prefers to remain anonymous (you’ll see why soon enough).

Dear Mark,

There’s been a lot of ballyhoo recently about your IPO and your choice of investment bankers. Indeed, a war was fought by the banks to win your “deal of the decade.” As reported in the press, the competition was so intense banks slashed their fees in order to win your business. Facebook is “only” paying a 1% “commission” for its IPO rather than the 3% typically charged by the banks.

Congratulations, Mr. Zuckerberg! On the surface it appears your pals in investment banking have given you a quite a deal!… Or have they?

Let’s take a closer look and see what you’re getting for your money.

To start, your bankers have the task of selling 388 million Facebook shares to the public. In return, these banks will receive $150 million for their efforts. Morgan Stanley will get the largest share of that amount—approximately $45 million. But is $45 million all that Morgan Stanley makes off your deal?

Before we answer this question, let’s first dissect the sales pitch that Morgan Stanley probably gave you to justify “only” the $150 million fee. We’ll look at what they told you, and then what that actually means.

1) We will raise the optimal amount of money for the company, for our 1% fee. (Translation: How great is it that Zuckerberg believes he got a great deal by getting us down to a 1% fee! We can’t believe he got hoodwinked into agreeing to any level of what are actually variable commission fees.)

2) The definition of a successful deal is having a good price “pop” on the first day of trading. This will make all parties happy and you, Mark, look like a rock star. (Translation: No one benefits more than us if Facebook’s share price rises significantly on day one. That first day price “pop” will take money directly out of your pocket and puts it in ours and those of our “best friends”—not yours or the public stockholders. We will, at almost all costs, make this happen.)

3) This is a very complicated process, especially for such a large company, but we are here to successfully guide you through it. (Translation: It actually takes the same amount of work to do a large IPO as a small one. Thus for approximately the same amount of work we’re doing for Facebook, we sometimes get only $10 million—$140 million less than we’re making on Zuckerberg’s IPO.)

4) We will perform due diligence on your company to make sure the business and its finances are as they seem. (Translation: While it certainly does take some time and effort to perform reasonable due diligence, Facebook is a very large and well-known company, and we have done this same procedure hundreds of times.)

5) We will write a prospectus that outlines Facebook’s strategy, business plan, financials, and risks, and we will get it approved by the SEC. (Translation: Per the regulatory guidelines, a prospectus is largely a boilerplate document; for the most part, it’s just a lot of cutting and pasting.)

6) Once this prospectus is completed and with input from the Facebook team, we will come up with “the range” or the approximate price we think your IPO shares should be sold at to the fund managers. (Translation: The price of your IPO will be determined by where and how we can best optimize our (secret) profits on the deal.)

7) We believe the best shareholders are large fund managers, as they will become long-term holders of Facebook stock. However, at your request, we will allocate 25% of the IPO shares to sell to individual investors. (Translation: There are 835 million Facebook users worldwide. One could argue that what is best for Facebook would be to let all of Facebook’s legally eligible customers enter orders to buy Facebook stock. Then through the broker of their choosing, they could enter the quantity of shares they want to buy and the price they want to pay, just like the fund managers do—or are supposed to do. More on this scenario below.)

8) Our 10-day sales process will begin. For this important “road show,” you will be introduced to our large fund manager clients. These fund managers will receive our pitch for why they should buy your stock, and we will assess their interest and at what price. (Translation: Far from being long-term holders, many of our large fund manager “best friends” will, as soon as Facebook shares start trading, sell (or “flip”) for a windfall profit on all the underpriced shares we’ve given them. We’ll enable this by creating a perceived “feeding frenzy” for the stock by putting out an artificially low initial estimate ($28 to $35 per share) for where we think the IPO will be priced. We will then raise that estimate during the road show. Rumors about this begin to circulate over the next day or so.)

9) At the end of the road show on the night before the IPO, we will review the overall supply and demand for the stock and then “price” the shares. This is the price at which the large fund managers will receive their “winning” Facebook shares. (Translation: The price of the stock is already known. For the past few years, Facebook shares have been actively trading on such venues as SecondMarket and SharePost.)

10) And finally, we will put a mechanism, called a Greenshoe, in place that “supports” your share price after the IPO. (Translation: Thank God Zuckerberg doesn’t understand one of the greatest investment banking profit enhancing creations of all time—“The Greenshoe.” The Greenshoe will likely be our most profitable part of this deal. It’s a secret windfall, and although we market it to Facebook as a method to stabilize its share price, it’s really just another way for us, with little effort, to make huge amounts of money.)

We’re not done yet, Mark. Now, I’d like to dig a bit deeper into what’s going to happen and show you all the additional ways your banker friends and their large fund manager clients are going to make oodles of money off your deal.

1) Morgan Stanley only gives Facebook shares (“golden tickets”) to their best client “friends.” In other words, it’s no coincidence that Morgan Stanley’s biggest fund manager clients get the bulk of the shares offered in this kind of deal.

2) How do you become best friends with Morgan Stanley? There are lots of ways, such as trading tens of millions of shares with them or using the firm as your prime broker.

3) I’m sure there are a lot of conversations going on right now between Morgan Stanley’s salespeople and their clients. These conversations are probably along the lines of (wink-wink) “before we allocate our Facebook shares, we’d like to ask first if you plan to do more trading with us over the next week to six months….”

4) Let’s assume that 50 of Morgan Stanley’s “best friends” trade an extra 2 million shares so they can get access to more shares of the Facebook IPO. Let’s also assume that the average commission these clients pay to Morgan Stanley is 2 cents per share. Well, those extra trades will dump an additional $2 million dollars into Morgan’s coffers.

5) Now comes the part where Morgan Stanley actually gives free money to its friends. If the Facebook IPO is like the majority of other recent Internet offerings, here’s what Morgan Stanley will likely do. They know Facebook will be a “hot” deal. Especially, with all of the “5% orders” coming in, there will be huge demand for Facebook shares. My prediction is that Morgan Stanley will “price” Facebook at approximately $40 per share. This is the price at which Morgan Stanley’s “best friends will be able to buy the bulk of the 388 million shares offered.

6) Now let’s now assume that Facebook shares open for trading at $50—a lower percentage premium than Groupon’s opening share-price “pop.”

7) Let’s assume that one of Morgan Stanley’s “best friends” decides to sell 3 million shares right after the opening at $50 per share. That “best friend” will instantaneously make a $30 million profit. That’s right, a $30 million profit.

8) Here’s a question for you Mark. If Morgan Stanley’s “best friends” are selling Facebook shares at $50, who’s buying them? The answer is your “friends,” individual investors, most of whom are your customers.

9) Now for the final insult—the Greenshoe. Technically speaking, the Greenshoe gives your investment banks a 30-day option to purchase up to 15% more stock from Facebook than was registered and sold in the IPO. In layman’s terms, this means that, over the next 30 days, your “best friends” at the investment banks are able to buy approximately 50 million of your shares at $40 per share.

10) As in our example above, let’s say Facebook shares do trade at $50 soon after the IPO. Now I am a simple person, but if I were given the opportunity to buy something at $40 that I could immediately sell at $50, I would do it all day, every day…. And so will the investment banks. The Greenshoe actually gives these banks the ability to do this for 50 million of your shares.

11) So let’s assume that Morgan Stanley and its other banking “friends” buy 50 million shares at $40 per share and then sell these shares at $50. Morgan Stanley and its banking “friends” will make an additional $500 million- yes, $500 million- a HALF BILLION DOLLARS off your company.

So let’s now do a tally to see how much money all of your banking friends are going to make just for the privilege of doing your IPO. Let’s also see where this money comes from.

“Discounted” fees/commission: $150 million

Greenshoe profits: about $500 million

Extra trading commissions from large fund managers: approximately $10 million

—————

Investment Bank Profits: $660 million

As the lead bank on your deal, Morgan Stanley is likely to get 30% of the overall take. This means that your closest investment banking “friend” will make a bit more than $200 million from your IPO.

Morgan Stanley and the rest of the investment banks involved will also make sure that their favorite fund manager client “friends” are given lots of free money. Assuming that these “friends” are given 75% of the total number of IPO shares, or a total of 291 million shares, and assuming that the stock does rise from $40 to $50, then these fund managers will collectively, in one day, make $2.9 billion dollars in realized or unrealized profits. That’s right, 2.9 BILLION DOLLARS.

Mark, by now you must be asking yourself the obvious question. “Where and out of whose pocket does this money come from?”

Well, just think of it this way… Let’s assume you own a very expensive piece of waterfront real estate, and you hire a broker to sell it for you. After exploring the market and after getting indications of interest, your broker advises you that $10 million would be a great price for your home. You meet with the potential buyers and decide to sell it for $10 million. After the $1 million commission you have to pay your broker, your net proceeds are $9 million. An hour later, you drive by the house and see your broker in the driveway shaking hands with some different people. You pull over to see what’s going on, and you find that the people you just sold the house to for $10 million are very close friends of your broker. To your dismay, you also find out that those friends just sold your (former) house to somebody else for $15 million.

The same exact game is going on here, Mark. You’ll be selling 388 million shares of Facebook stock in your IPO. A likely scenario is that your broker “friends” are telling you to sell your shares at $40 per share. You’ll take their advice and sell at $40 per share, and the buyers will be Morgan Stanley’s biggest fund management clients. By the time you drive around the block, these folks will have sold their shares at $50 per share. In other words, using the same real estate scenario, you’ll have sold something of yours for $15 billion that is really worth $19 billion. And for that “unique” privilege, you’ll be paying your “friends” at the banks $150 million as a fee.

Makes you wonder who your real friends are…

————-

End of letter

————-

I find the points that my (real life) friend makes here highly disturbing, but I suspect that they also fit with what we now know about dishonesty.

First, although there are many ethically questionable practices occurring here, it’s not clear that anything illegal is going on. Second, I think that while this banking industry’s IPO process is artfully designed in such a way that, although overall it’s good for the bankers and less so for the companies, no single individual believes he/she is doing anything wrong. Third, I also suspect that since this is such a common practice, the bankers most likely truly believe that mechanisms such as getting a first-day IPO “pop” is great for Facebook and that the Greenshoe is fact put in place to stabilize the Facebook stock price, and not simply to generate more windfall profits for themselves. Forth, they probably believe in their own definition of a “successful” IPO, which in their terms is one where the stock is priced at $40 and quickly trades up to $50. In the case of Facebook, this process simply redistributes $4 billion from Facebook to the banks and the large fund managers. For Zuckerberg and his team, I have to wonder whether the emotional value of a first day share price “pop” is worth $4 billion.

I am not sure about you, but I find all of this very depressing.

Irrationally yours,

Dan

Tweet

Tweet  Like

Like