My Birthday

So, today is my birthday and this year it is also the wedding day of prince William and Kate.

How do I feel about this? Well, there is some interesting research showing that when kids have their birthday on a special day (Christmas, new year etc), they are likely to feel less special and suffer in terms of their confidence and social fit.

I was wondering if this would also happen to me, but then one of my friends made me realize that I need to be less selfish and also consider how this joint celebration might affect the well-being of prince William and Kate.

I do hope that they will continue to feel special despite the selection of their wedding day.

P.S I met the Duke of York earlier in the year and I asked him if the timing of this wedding means that I should be invited – but surprisingly he said “no.”

The Upside of Useless Stuff

There’s been plenty of talk lately –in these pages and elsewhere– about a new kind of capitalism. About creating things because they’re good for society. About understanding, as Michael Porter and Mark Kramer suggest (“Creating Shared Value,” HBR January-February 2011), that not all profits are created equal: Profits derived from making the world better are superior to those derived from the consumption of useless, or even harmful, junk.

At the risk of touching the third rail, I propose that getting people to want things they don’t really need may be far more valuable to society than we think.

Imagine that I started a business selling beautiful bottles of air for $10. I’d call them Respirer (res-pir-AY– it’s French!). My advertisements would laud Respirer’s purity, evoking bracing mountain air. (Fewer than 10 parts per trillion of particulate in every bottle!) Celebrities would endorse Respirer’s rejuvenating effects. (Kate Winslet starts every day with Respirer!) In a matter of months, department stores would be selling out, and spas would brag that their saunas piped in pure Respirer air.

Respirer would be a runaway hit. Of course, it would be just air, and in most places you could get all the reasonably high-quality air you wanted free. So how could this clearly useless product have a beneficial effect on the economy? It would motivate people. By hyping Respirer, I’d give consumers something to want, and in order to be able to afford it, they’d have to work. They’d have to be productive.

We often talk about how marketing’s job is to get us to want things and spend our money, sometimes foolishly. But that reflects only marketing’s output. Marketing also creates input: It spurs us to work to earn the money to buy the things we want.

Consider for a moment a world without marketing hype. One in which there’s nothing you really desire beyond what you need to live. There’s nothing your kids want; they don’t bug you every time you’re in the supermarket. How hard would you work in such a world? What would motivate you to work harder?

Now consider our current consumer environment: Multiply the desire for Respirer by thousands of products of varying levels of utility: iPads, leather couches, crystal martini glasses, cars, garden gnomes. It’s like having thousands of little motivational speakers hovering around us.

Suppose I’m a surgeon. Could it be that my desire for Respirer, and all this other stuff, would spur me to work harder? To innovate new procedures that would save lives and also enrich me personally? I suspect it’s very likely.

Let’s be clear. I don’t mean to say that marketing will save our economy. Or that marketing things we don’t need is the key to a prosperous planet. The line is narrow, indeed, between being motivated to work and mortgaging the future (both your own and society’s) to get stuff like bottled air.

Still, as we continue to redefine capitalism, let’s not discount the role of aspiration and the desire for incremental luxuries–things we want but don’t necessarily need. They can fuel productivity and thus have a valuable function in our economy.

Originally published in Harvard Business Review, May 2011.

The Opportunity Cost of Sitting in the Back Seat: Wisdom Gleaned from Rebecca Black's "Friday"

The concept of opportunity cost can be seen in the emergent societal dilemma presented by Rebecca Black through her insightful lyrics:

“Kickin’ in the front seat

Sittin’ in the back seat

Gotta make my mind up

Which seat can I take?”

As we can see, Rebecca must choose between kicking in the front seat and sitting in the back seat – two mutually exclusive options where her choice of either eliminates the opportunity to choose the other.

The same evaluation of opportunity cost can be seen in monetary exchanges that we make every day. In my dissertation work, I’ve focused on when consumers are more or less likely to reframe purchase decisions (like “Do I buy Rebecca Black’s ‘Friday’ or not?”) as allocation decisions (like “Do I buy Rebecca Black’s ‘Friday,’ or do I spend my money on something else instead?”).

Two important drivers are:

1) how constrained consumers feel

2) how much their resources bring other purchases to mind

First, I find that when consumers face more constraints, they are more likely to incorporate other purchases into their decisions. This constraint can be driven by cash on hand, annual income, or even the cycle on which you are paid. People paid weekly face less constraints on average (at least until the end of the month) than those paid monthly. As a result, those paid monthly are more likely to think “Do I buy this CD or not?” whereas those paid weekly are more likely to think “Do I buy this CD or do I spend my money on something else instead?”

Second, consumers can actually be more likely to fixate on their opportunity costs when they use resources with specific associations. Think about spending a Starbucks gift card versus a Visa gift card to buy Rebecca Black’s CD (imagining that it could be on the eclectic menu of CDs at Starbucks). The Starbucks gift card immediately makes you think about the coffee you could buy, so the decision changes from “Do I buy the CD or not?” to “Do I buy the CD or coffee?” The Visa gift card could be used to buy nearly anything but it doesn’t make you think about something else in particular, so the decision remains “Do I buy the CD or not?” What does this mean in practice? Starbucks coffee lovers are actually more likely to spend the Visa gift card than the Starbucks gift card even though the Visa gift card could be used to buy anything – including a Starbucks gift card!

Here at the Center for Advanced Hindsight, we see these factors at play constantly — and not just when spending money. At the beginning of the day, I have plenty of time (or convince myself of that at least), so the decision to write a blog post is “Do I write it or not?” but at the end of the day, the decision is “Do I write it now, or do I work on my paper, or do I watch the ‘Friday’ video, or do I go to sleep?” Some times of day have specific associations, so at 10:00am, the question may be “Do I write the blog post or not?” whereas as at 12:00pm, the question is “Do I write the blog post or do I eat lunch?” Take a guess when I finally got around to writing this… But our discussion of procrastination will have to wait for another day.

For more details, see “Opportunity Cost Consideration,” forthcoming in the December 2011 issue of the Journal of Consumer Research.

~Stephen Spiller~

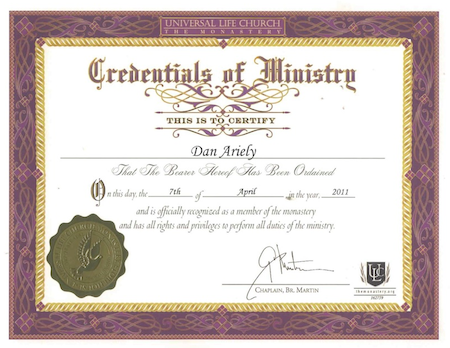

I am ordained!

At the suggestion of my friend, Sarah Szalavitz, I went to http://www.themonastery.org/ and within a few minutes become an ordained minister.

It wasn’t a deep spiritual experience, but the website tells me that in a few weeks I will get a certificate that will allow me to officiate weddings, baptisms, funerals, and blessings. Apparently I will also be able to start my own religion and perhaps most exciting — to absolve people of their sins.

From all of these possible directions and options, I think I would like to start small – baby steps – and maybe try my hand at a wedding or two. My only question is what an irrational wedding ceremony would be like. Should I give a speech about all the irrational aspects of getting married? Should I point to the challenges of living together for prolonged periods of time? What about the irrationalities of having kids? Or should I take a more optimistic approach and while pointing to the challenges also suggests ways to overcome some of them?

As you can see, I am open to suggestions.

Irrationally yours

Dan

Can the tax code cause us to spend too much?

April 15th — Tax day is upon us, so it’s a perfect time to contemplate a few aspects of taxes.

In the past I’ve written about how I used to think that tax day was a wonderful day of civic engagement – a day to think about how much we make and contribute, what taxes we pay and what services we get in return. Of course, over the years, as my taxes have become more complex, this task becomes one that is less about civic engagement and thoughtfulness, and more about annoyance and frustration. But that’s for another time.

Today I want to talk about the fact that the US tax system makes it very difficult for us to understand how much money we make and how this may actually lead us to spend more money than we really have. Think about it for a moment—do you know your net monthly income? I suspect you don’t, and I think that the tax system is to blame.

In many other countries, the tax code does not allow for the same level of deductions we have, and because of that for most people the whole amount of taxes is automatically deducted from their paycheck – and this is it. Now, in this situation when you ask people how much they earn [and yes, in other countries people do actually ask each other what they make] they will tell you their net monthly income – the amount of money that they get to take home at the end of each month. How do they know? Well, it is the number that is printed in bold letters on their paystub.

Contrast this to the US. In the US, we all know the gross amount that we make a year, but it’s not as clear what our net income is. It’s actually very complex because we get our salary, some of which the employer withholds, and we have no idea what we’ll get back when tax day comes around. We can get back some money (depending on our expenses/deductibles), trends in our stock market portfolio, health care, etc. And we don’t figure this out until April 15th (if not later) of the following year!

And what are the consequences of knowing our gross yearly income and not much else? I think it causes us to feel richer than we really are and spend accordingly. Why would this be the case? There’s a phenomenon we call the “illusion of money,” which is the idea that we typically pay attention to nominal amounts of money rather than real amounts. For example, the illusion of money means that if inflation is 8%, and you get a 10% raise, you would feel better than if there was no inflation and you got a 3-4% raise. The basic idea is that we pay attention to the nominal amount rather than the purchasing power, and don’t realize what our money is really worth.

In terms of our tax code, this suggests that in the US we focus on our gross yearly income, feel richer than we really are, and consequently end up spending more money. If this is right, it means that changing the structure of deductions could be one way to help people understand how much money they actually have and how they can save more.

The Rationality of One-Star Reviews

When publisher Hachette Book Group set its price for Michael Connelly’s latest suspense thriller, The Fifth Witness, it decided to charge $14.99 for the Kindle version and $14.28 for the hardback version, a difference of $0.71.

From a utility point of view, charging more for the Kindle version seems quite reasonable considering that Kindle books are delivered instantly and for free, that they take up no additional space or weight, that they can be read on any computer, and that they come with handy bookmarks and highlights of what other readers find interesting.

But how did customers respond to this pricing decision? They were outraged! As you can see on the product page, the book has been overwhelmed with one-star reviews based not on the quality of the book itself but instead on the perception of greed and unfairness on behalf of the publisher. “junk,” writes Amazon reviewer Juan M. “It’s ridiculous that the E-BOOK is as much as the physical copy. Greed indeed.”

Talia S. puts it this way: “I went and check the reviews and notice the many 1 star grading. I read some of them and changed my mind. I did not buy the book. We should not let the publishers hold us hostage because we prefer to read the electronic format.”

While standard rational economics tells us that consumers will be willing to pay more for items they derive more utility (pleasure and usefulness) from — in practice, other factors such as perceived fairness and perceived manufacturing costs play a very large role into our decisions of what to buy and how much we are willing to pay.

As someone who has published two books, and purchased a lot of them over the years, I find books to be one of the most puzzling categories in terms of how much attention people pay to their price. Think about it this way — if you were going to spend 10 hours with a book, do you really care if it costs $3 more? Shouldn’t you happily pay $0.30 more per hour of reading if the quality of the book was slightly higher or the experience was slightly better? Personally my more pressing problem is time, and if someone could assure me a better, even slightly better experience, I would pay a substantial amount more. And for some books, those I really treasure and that have changed my view on life — if I were just thinking about the utility of my experience I would pay hundreds of dollars.

The problem is that it is really hard to think this way. It is not easy to focus on what we really care about (the quality of the time we spend) rather than the salient attribute of price. And on top of that the unfairness of the differences in price can make us mad ….

I don’t know how the book industry will deal with this problem, and I am looking forward to seeing how this story develops. But, I do know that as readers we should pay a little less attention to minor differences in price and more attention to the quality of the way we spend our time.

Irrationally yours

Dan

A tribute to my son

A tribute to my son, Amit who is 8 years old — and came up with a very similar poem by himself today

Sick

By Shel Silverstein

‘I cannot go to school today, ‘

Said little Peggy Ann McKay.

‘I have the measles and the mumps,

A gash, a rash and purple bumps.

My mouth is wet, my throat is dry,

I’m going blind in my right eye.

My tonsils are as big as rocks,

I’ve counted sixteen chicken pox

And there’s one more-that’s seventeen,

And don’t you think my face looks green?

My leg is cut-my eyes are blue-

It might be instamatic flu.

I cough and sneeze and gasp and choke,

I’m sure that my left leg is broke-

My hip hurts when I move my chin,

My belly button’s caving in,

My back is wrenched, my ankle’s sprained,

My ‘pendix pains each time it rains.

My nose is cold, my toes are numb.

I have a sliver in my thumb.

My neck is stiff, my voice is weak,

I hardly whisper when I speak.

My tongue is filling up my mouth,

I think my hair is falling out.

My elbow’s bent, my spine ain’t straight,

My temperature is one-o-eight.

My brain is shrunk, I cannot hear,

There is a hole inside my ear.

I have a hangnail, and my heart is-what?

What’s that? What’s that you say?

You say today is…Saturday?

G’bye, I’m going out to play! ‘

Squash and Our Intuitive Strategic Thinking

As you may or may not know, I am a fairly avid squash player (not so good but I love the game). One of my favorite aspects of squash, aside from being a great source of exercise, is the strategic thinking required.

The other day while playing, I had a slight itch to change strategies. It wasn’t a conscious, logical process, and it was more like a kind of the desire to itch or pick a scab. Like picking a scab, my better judgment told me that making this switch would be a bad idea, but the urge was too great, and I switched my playing style. And it worked!

After the game I wondered, where does this itch come from? Is it part of our creative instinct for exploring and trying out new strategies? Do we have a desire to try new things?

Benefits of deadlines

Here is a letter I got a few days ago:

—————————————————————

Dear Dan,

I recently had an experience that I thought you might be able to appreciate and wondered if you had any thoughts on it.

Last fall (early October) I got into a small car accident. It was my fault and I was ticketed for not controlling the speed of my vehicle. As a part of my plea with the courts I agreed to take a defensive driving course. The last time I took one of these, I selected one Saturday that worked for me and met with a teacher in a classroom for 6 hours one day. But in my state (Texas), they don’t have face-to-face courses anymore; they only have online courses. Of course, the court can’t tell you where to go to sign up for these courses, you have to find it on your own. There are LOTS of options. In addition, taking the course basically requires a commitment of 6 hours, but there are no scheduled class times. Instead, you choose whenever you want to begin your course.

I teach at a Community College fresh out of graduate school. I’ve got a family and I’m super busy. Essentially, this means that I never have a block of 6 hours to devote to anything. As a result, I put off this course for longer than I should have and am now in contempt of court and have been summoned to appear in a little over a week. Today, actually, I’m taking the course…

Anyway, I feel like this is a perfect example of how the courts think they’ve made this process easier, when in fact they have shifted a lot of the decision-making burdens on the plaintiffs, making compliance a lot more difficult. I’m not a delinquent, but I feel like the burdens of completing this task have turned me into one. I don’t have access to data, but I’d be willing to bet that delinquencies are much higher under the new system as opposed to the old.

Unfortunately, irrationally, and procrastinatingly yours,

Nathan

—————————————————————

Dear Nathan,

The same basic thing happened a while ago in the scientific community. The organization that funded science in the UK decided that instead of asking people to submit grants by 2 specific dates each year (which is that the US funding agencies do), and get people all stressed over the deadlines — they will let people submit grant at any time and they will review the grants using the same 2 times a year. What happened? Much like your story, fewer grants were submitted and eventually the Brits changed back to the twice a year setup.

All this is to show us how useful deadlines can be.

Irrationally yours

Dan

Introducing Friend Measure

How well do you know your friends? We have created a really fun game on Facebook that lets you measure just that. It’s called Friend Measure.

Here’s how Friend Measure works: every week Friend Measure asks you and your friends a question. For example:

Q: If the teller at your bank gave you an extra $1,000 and you could take it and never get caught, would you?

A: Yes

B: No

Here’s the twist: not only do you answer for yourself, but Friend Measure also asks you predict what your friends would answer as well. Once you’ve made your predictions, Friend Measure calculates your “Friend Score,” which lets you know how well you really know your friends. If you think about it, this “friend score” can tell us a lot about the kinds of questions we’re asking. So far we’ve found some really surprising results.

For example: we asked “Can you tell the difference between wine that costs about $10 a bottle and one that costs about $40 a bottle?” 75% of respondents admitted, no, they can’t tell the difference. Even more surprising though, is that they thought that about 58% of their friends could tell the difference. Respondents’ overall accuracy for predicting their friends was 53%, which is basically no better than chance.

Here’s one in which users were really good at predicting their friends’ responses: we asked, “Do you think that increasing the tax rate for the wealthy by 10% will get rich people to work less?” Respondents were 84% accurate in guess their friends’ responses, because we typically know our friends’ political affiliations really well.

From time to time, I’ll be sharing interesting findings like these here, but only if you participate! Enjoy!

Tweet

Tweet  Like

Like