First review of DOLLARS AND SENSE

This is a review from Kirkus and they are not easy to please…

DOLLARS AND SENSE

How We Misthink Money and How to Spend Smarter

Author: Dan Ariely

Author: Jeff Kreisler

Illustrator: Matt Trower

Review Issue Date: September 15, 2017

Online Publish Date: September 4, 2017

Publisher:Harper/HarperCollins

A lively look at how even the wisest among us are too often fools eager to part with our money.Most of us think about money at least some portion of each day—how to get more of it, how to spend less of it. However, cautions Ariely (Psychology and Behavioral Economics/Duke Univ.; Payoff: The Hidden Logic That Shapes Our Motivations, 2016, etc.), working with comedian and writer Kreisler (Get Rich Cheating, 2009), “when we bring money into the equation, we make the decisions much more difficult and we open ourselves to mistakes.” The better course, they urge, is to consider money not for its own sake—indeed, not to acknowledge its existence at all—but instead to consider the concept of opportunity cost: what do we give up when we make one choice over another? Is the forgone acquisition really the correct one? What if, instead of buying a big-screen TV or new clothes, we thought of what we might do with the hours we don’t have to work in order to procure them or of the other things we might buy in their place? Such counsel comes after consideration of other economic notions, such as the endowment effect, whereby we give more significance to things simply because we own them, and our generally risk-averse economic behavior, whereby the pleasure taken in gaining something is vastly overshadowed by the pain caused by losing it. Ariely and Kreisler, writing breezily but meaningfully, allow that money has its uses as a symbolic system of fungible, storable, accessible value. However, the real consideration should always be that “spending money now on one thing is a trade-off for spending it on something else,” a calculation that is not often reckoned simply because it’s more difficult than fishing out a credit card or some other means of delaying the recognition that spending money now has future, downstream effects. A user-friendly and often entertaining treatise on how to be a more discerning, vastly more aware handler of money.

Beginning at the End

Part of the CAH Startup Lab Experimenting in Business Series

By Rachael Meleney and Aline Holzwarth

Missteps in business are costly—they drain time, energy, and money. Of course, business leaders never start a project with the intention to fail—whether it’s implementing a new program, launching a new technology, or trying a new marketing campaign. Yet, new ventures are at risk of floundering if not properly approached—that is, making evidence-based decisions rather than relying on intuition.

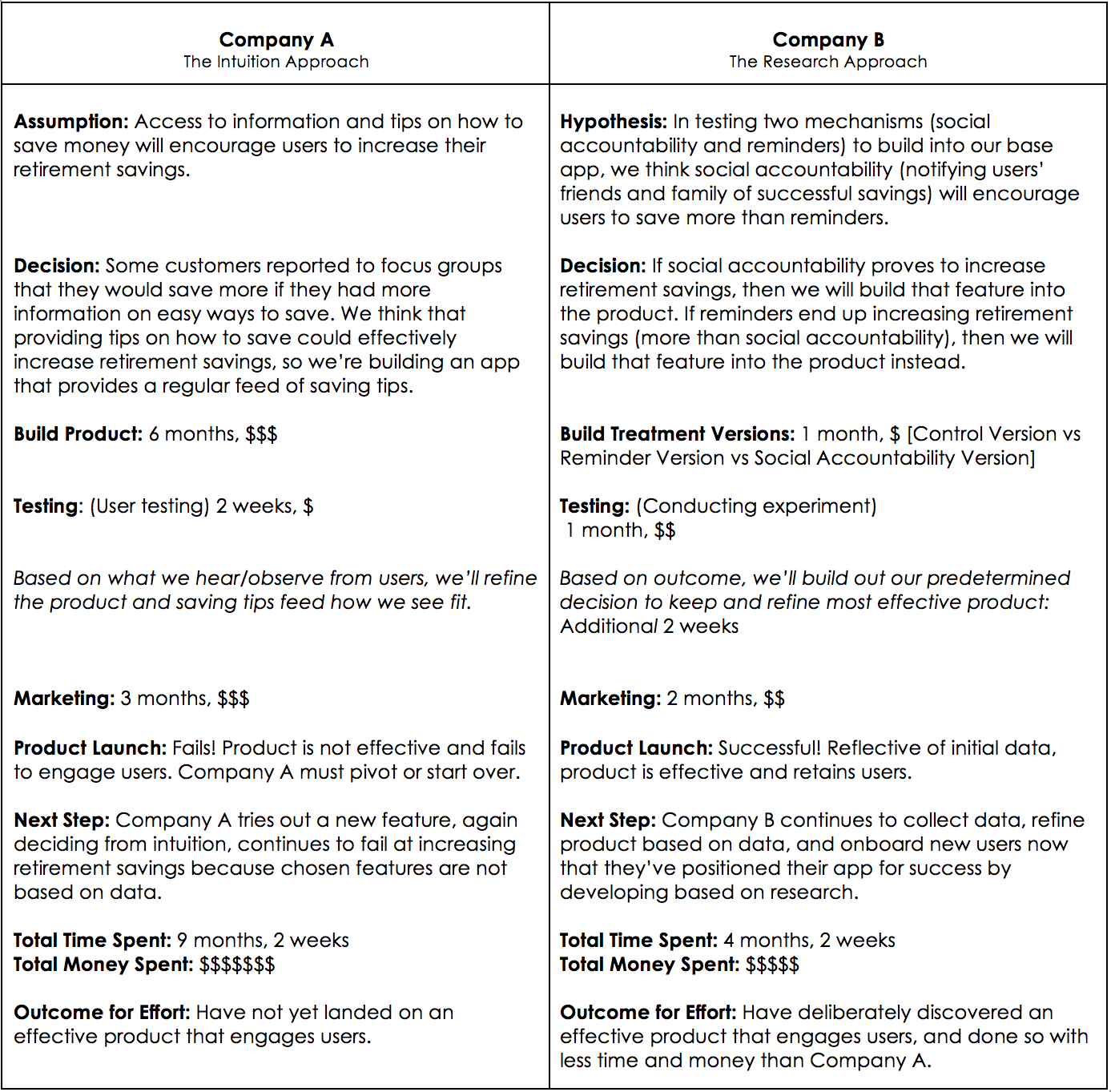

Let’s say your company is in the business of connecting consumers to savings accounts, helping them save for retirement through your app. You need to decide how your product will achieve this. Let’s look at how an intuition-backed approach (Company A) compares to a research-backed approach (Company B) in this scenario:

What if there was a way to more reliably ensure that business risks weren’t as prone to failure? As we see in the example above, the solution lies in well-planned experimentation.

If businesses can learn to identify concrete decisions needed to move new or existing projects forward, and set up experiments that directly inform those decisions, then much of the painful time, energy, and monetary costs of mistakes can be avoided. However, many business leaders and entrepreneurs are weary and unsure about how to leverage research to benefit their companies most effectively. Therefore, they rely (perhaps unknowingly) on riskier decision-making approaches.

As social scientists at Dan Ariely’s Center for Advanced Hindsight at Duke University, we’re in the business of human behavior and decision-making. We see in our research the effects that our biases and environments have on our ability to make optimal decisions. In the high-risk environment of building a company, founders aren’t well-served by calling shots based on gut feelings or reasoning plagued by cognitive biases. (Don’t feel bad! We’re only human!)

The better route? Rigorous experimentation. Asking well-formed research questions, designing tests with isolated variables and control groups, randomizing users to groups, and using data to inform business decisions.

Adapting the Process: Making Experimental Results Actionable

At the Center for Advanced Hindsight’s Startup Lab (our academic incubator for health and finance technologies), our mission is to equip startups with the tools to make business decisions firmly grounded in research.

But the research process has to be more accessible to businesses. Entrepreneurs often come to us excited about research, but with little to no idea of what it takes to execute a rigorous experiment. There’s a lot of anguish, confusion, and hesitation about where to even begin.

The Startup Lab makes experimentation more approachable to entrepreneurs who have the will, but often not the time and resources to run studies like our colleagues in academia.

There are specific considerations that businesses take into account when wading into the world of research. An important one is what makes investing in experimentation worthwhile? The driving purpose of running experiments, in most business contexts, is to uncover results that are clearly actionable.

So how do you ensure actionable results? You set up your process with this goal in mind from the start – not as an afterthought. The Startup Lab adapts Alan R. Andreasen’s concept of “backward market research”[1] to bring the process of planning and executing a research project to entrepreneurs.

The ‘Backward’ Approach: Beginning at the End

“Beginning at the end” means that you determine what decision you’ll make when you know the results of your research, first, and let that dictate what data you need to collect and what your results need to look like in order to make that decision.

This ‘backward’ planning is not how businesses usually approach research projects. The typical approach to research is to start with a problem. In business, this often leads to identifying a lot of vague unknowns—a “broad area of ignorance” as Andreasen calls it—and leaves a loosely defined goal of simply reducing ignorance. For example, startups often come to us with the goal of better understanding their customers. While we commend this noble goal, we ask, “to what end?”

What business decision will you make based on what your research uncovers?

The problem with the simple exploratory approach is that it sets you up for certain failure from the start. An unclear question produces an unclear answer. You’ll end up with data that you can’t possibly base a concrete decision on.

Let’s revisit the example of Company A (the intuition-based entrepreneurs) and Company B (their ‘backward market research’ counterparts). If you approach product development based on intuition like Company A, then you may be tempted to ask your customers about the challenges they have saving, or their ideal income at retirement – but this would be misguided if you don’t first determine what you will do with this information. If you find that your customers have trouble saving, you might conclude that you need to give them more information about the benefits of saving for retirement. If you create and implement this content into your app only to discover that it is completely ineffective at increasing savings, will you trash your product and start over? (Probably not. But if you set up your research in this way, then that may be the only logical conclusion.)

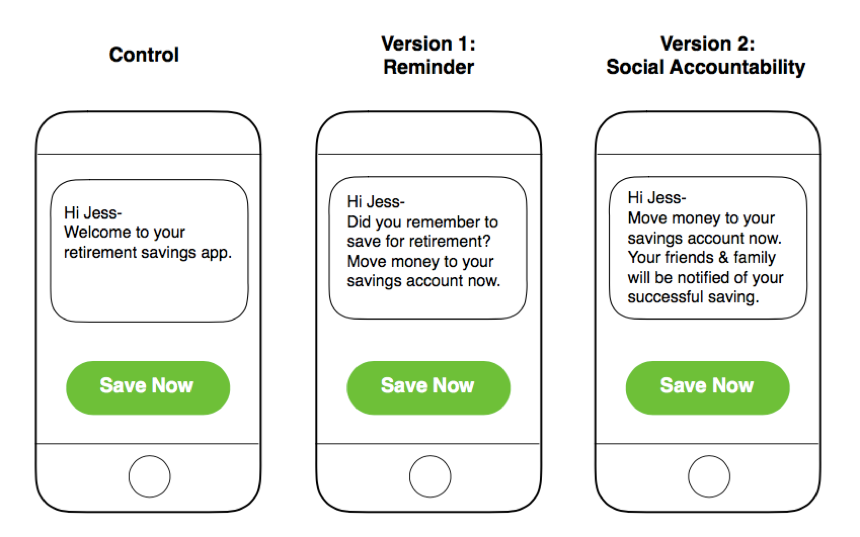

But imagine that instead, like Company B, you plan a research project to collect data on your users’ saving behavior (instead of probing to reduce your ignorance on their stated savings challenges). You set up an experiment to test two different ways of encouraging users to save (your two treatment groups, reminders and social accountability) against the current version of your product (what we call a control group).

Now you’ve set up an experiment, but you can’t stop at designing your research.

The “backward market research” approach forces you to specify which decisions you will make based on the outcome.

If the social accountability version leads your users to save twice as much as they do when using your base product, will you implement this mechanism in your product strategy? How will you do so, and what might the implications be? Once you determine 1.) The decision you will make from every possible outcome of your research results and 2.) How each decision will be implemented, then your research is set up to lead to actionable insights that have the power to move your business forward.

P.S. You too can design and conduct experiments using the ‘backward market research’ method. Use our handy tool to guide you through the backward approach: ‘Beginning at the End’ Worksheet.

And remember, to orient your research toward actionable decisions, start with the end in mind.

[1] Andreasen, A. R. (1985). ‘Backward’Market Research. Harvard Business Review, 63(3), 176-182.

At the Center for Advanced Hindsight’s Startup Lab, our academic incubator for health and finance tech solutions, we aim to instill a commitment to research-backed business decisions in the companies we bring into our fold. We will be releasing more articles and tools like this as part of our Experimenting in Business Series on our blog. Leveraging research for smart business decisions is a powerful skill—we’re aiming to make rigorous experimenting less intimidating and more accessible to a broad range of businesses.

By the way—we’re also accepting applications for the Startup Lab’s upcoming program, which starts in October. We’re looking for startups that are eager to experiment, and demonstrate a passion for building research-backed solutions to health and finance challenges.

APPLY NOW.

You only have until June 30th at 5pm EST.

Build better health and finance tech products for humans. Join the Startup Lab.

We’re excited to announce that we’re searching for our next class of the Startup Lab, which begins October 2017. Applications are only open until June 30th at 5pm EST.

Apply to the Startup Lab now.

Our academic incubator supports problem-solvers by making behavioral economics findings accessible and applicable. See how behavioral researchers and entrepreneurs work together at the Center for Advanced Hindsight:

The Startup Lab provides:

- Ability to explore behavioral economics and learn how to leverage findings for your startup

- Opportunity to collaborate with world-renowned behavioral researchers

- Guidance and resources to run rigorous experiments

- Office space in downtown Durham, NC up to 9 months (October-June)

- Investment up to $60k

Are you insatiably curious about what drives decisions, shapes motivation, and influences behavior? Does your startup’s success hinge on the ability to affect positive behavior change that helps people live happier, healthier, and wealthier lives?

We’re looking for startups that are eager to experiment, and demonstrate a passion for building research-backed solutions to health and finance challenges.

APPLY NOW.

You only have until June 30th at 5pm EST.

To learn more, visit our FAQs (includes information on the Startup Lab investment structure and other logistics) or connect with us at startup@danariely.com.

Last post about the INT

After a month on the INT

Ooops, emails sent by mistake

Earlier today, a number of my blog subscribers received several automated messages for “new” blog posts, which were actually previously-published posts from the Center of Advanced Hindsight (my research lab). This was an accident that came about as I was trying to integrate the two sites. (I certainly did not intend to spam you!)

My team and I temporarily shut down the site while we identified the cause of the issue and made sure the mailing server was disabled. I am happy to report that the issue has now been resolved.

Please accept my apologies for cluttering your inbox (a topic I am extremely sensitive to). We are taking steps to ensure that this doesn’t happen again.

Trust — a new talk

The Switching Type

Companies in the electric power industry want to keep their current customers and attract new ones. But when customers move to a new residence, they often switch providers. So, what’s the most effective way to convince these customers to switch back? A recent study suggests that goal-oriented go-getters are motivated not just by saving money, but by completing a task. Julie O’Brien, a research associate at Duke’s Center for Advanced Hindsight, discribes the “switching type” a personality trait and a novel way to appeal to customers.

And the iTunes link:

https://itunes.apple.com/us/podcast/the-switching-type/id420535283?i=1000377340352&mt=2

Tweet

Tweet  Like

Like